In any business GST billing is avery important step to function properly as per to the government rules. GST is important to pay for the benefit of the country. Not paying it can cause legal problems for our businesses but it is a repitive process that needs to be done after every transaction taking place, This makes it pretty frustrating sometimes but what would happen if you were given a website which made this work easy and fast. obviously that would be great and thus Patna Repair is here to help you with it..

Benefits of GST Billing website?

Time Savior: It saves alot of time if compared to the traditional ways when you had to type everything. It is because there are already designed bills and all that you need to do is to enter the values.

Cost Savior: It is a one time investment and then you will be able to do it on your own everytime without being dependent on those tech and law people for everything. And you will also not have to pay anything to those middlemen.

Ho more fustration: The boring, repetitive and time taking work becomes easier, faster and thus frustrates less.

How is GST bill created from the website?

You will be able to create Gst bill from our Website in the following Stages:

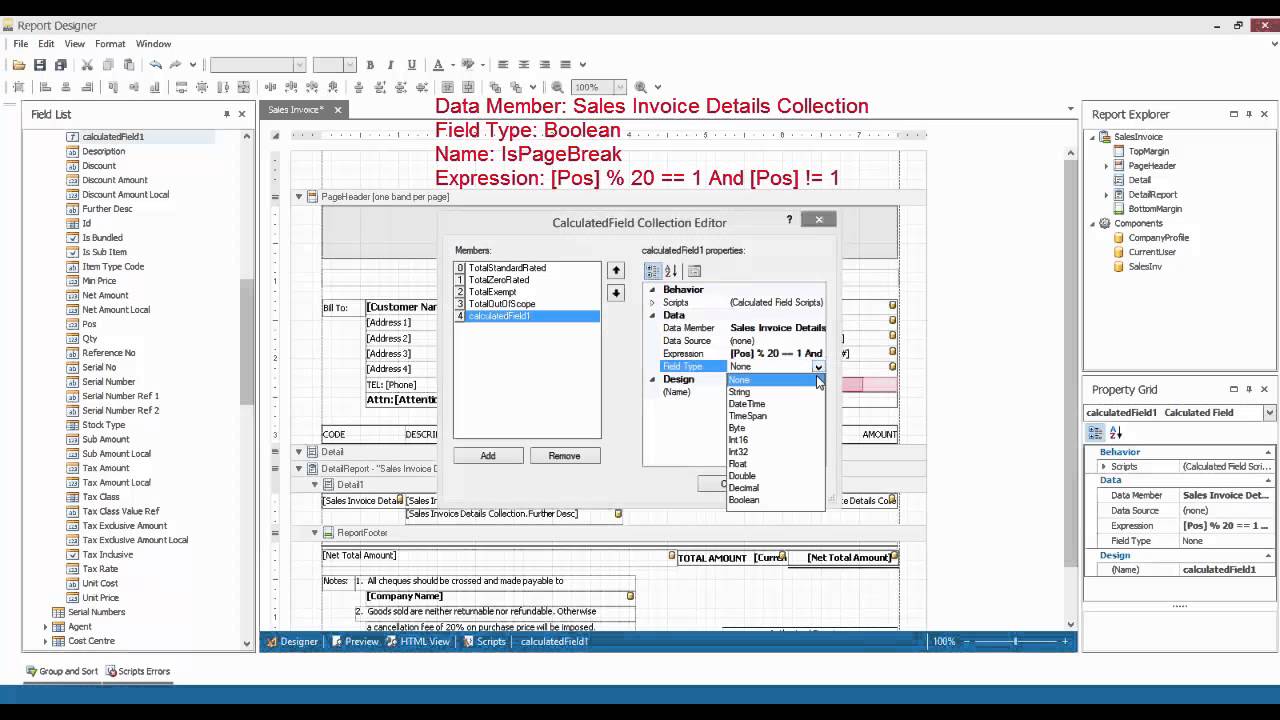

Stage 1: Create Invoice

From the top menu, select Sales - > Invoice. In the receipt, select the Branch from which the GST charge is to be given, if relevant. In the event that the business has just one branch, the alternative for choosing branch won't be accessible.

Stage 2: Select Invoice Date and Payment Due Date

Select the receipt date and the installment due date. On the off chance that installment is gotten alongside receipt, set installment due date as the date of receipt.

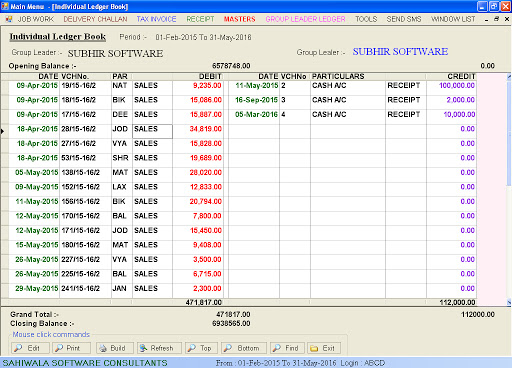

Stage 3: Select Customer

From the client menu, select the client. On the off chance that you don't see the client in the drop-down list, select Add Customer to add another client.

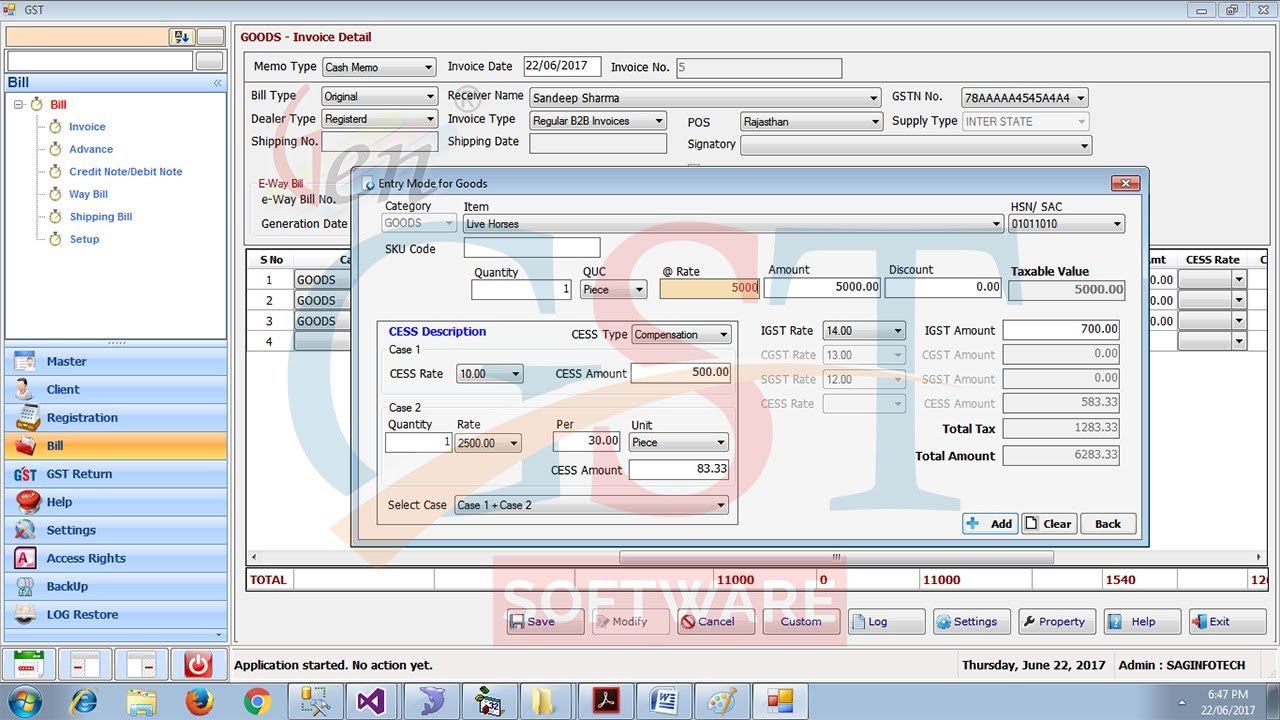

Stage 4: Verify Place of Supply

The spot of supply decides the sort of duty pertinent on the solicitations, IGST or CGST and SGST. Spot of supply is consequently populated dependent on the clients conveyance address. In the event that the clients conveyance address isn't accessible, spot of supply would be the providers State and the stockpile would be treated as an intra-state supply.

In the event that you might want to choose the spot of supply, select starting from the drop list.

Stage 5: Select the Goods or Services Supplied

When the client is chosen and spot of supply is resolved, select the merchandise or administrations provided starting from the drop list. On the off chance that the products or administrations provided isn't accessible in the drop-down you can add the thing from the Goods and Services menu.

When the merchandise or administrations is chosen, the rate, amount, rebate, IGST or CGST and SGST relevant for the thing will be auto-populated. You can refresh limits if any to register the last available worth. On the off chance that the information is worthy, click on the check imprint to add the thing to the receipt.

Stage 6: Update Additional Information

From the alternatives beneath, change invert charge is pertinent to indeed, if appropriate. At the point when converse charge is pertinent, the beneficiary will be liable for installment of GST straightforwardly to the Government.

In the event that the inventory is a fare or supply to SEZ, select the choice starting from the drop. For trade supplies, you will likewise need to give subtleties of transportation charge, dispatching charge date and port of fare.

In the event that you might want to add any extra charges to the receipt, select the kind of extra run after from the drop menu.

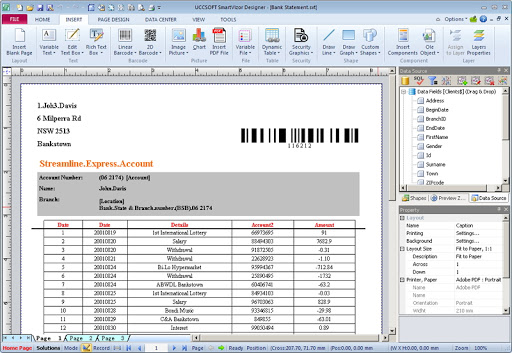

Stage 7: Create GST Bill

When every one of the subtleties in the page is finished, click on Create Invoice to produce a GST bill. You will actually want to download the archive in word and pdf design after the GST bill is produced.